Amundi Funds Protect 90, an active and flexible approach

Wednesday 30 November 2016

An active and flexible approach

Amundi offers investors a unique way to increase their returns through an active management strategy that offers a partial capital protection.

Today’s low interest rates leave people who are attempting to save money for their future with a difficult choice. Keep your money in a cash account and suffer negligible returns, and possibly a fall in the real value of your wealth after the impact of inflation. Or seek a higher yield by investing in the markets and accept the associated risks, including the possibility that the value of your assets will fluctuate and could fall substantially.

Amundi offers a third choice that is somewhere in between through an investment solution that targets higher returns, while offering a degree of comfort that your capital is partially protected against market volatility. As its name suggests, Amundi Funds Protect 90 provides a guarantee that your investment will remain above a certain level.

The fund’s partial protection feature locks in capital so that it will never fall below 90% of the highest net asset value (NAV) recorded since inception regardless of the underlying performance in financial markets. As the NAV rises, so does the partial capital guarantee providing reassurance to investors against the risks of economic and financial uncertainty.

Adapt to a changing environment

Amundi’s diversified strategy invests across all asset classes, global regions and types of investments. As well as helping to enhance returns through exposure to a wide universe of investment opportunities, combining uncorrelated assets helps to reduce volatility and offer smoother investment performance.

Amundi Funds Protect 90 is actively managed, giving the investment team the flexibility to adapt to the continuously changing environment through tactical asset allocation and security selection decisions. A dynamic portfolio composition is based on fundamental market analysis and investing with conviction.

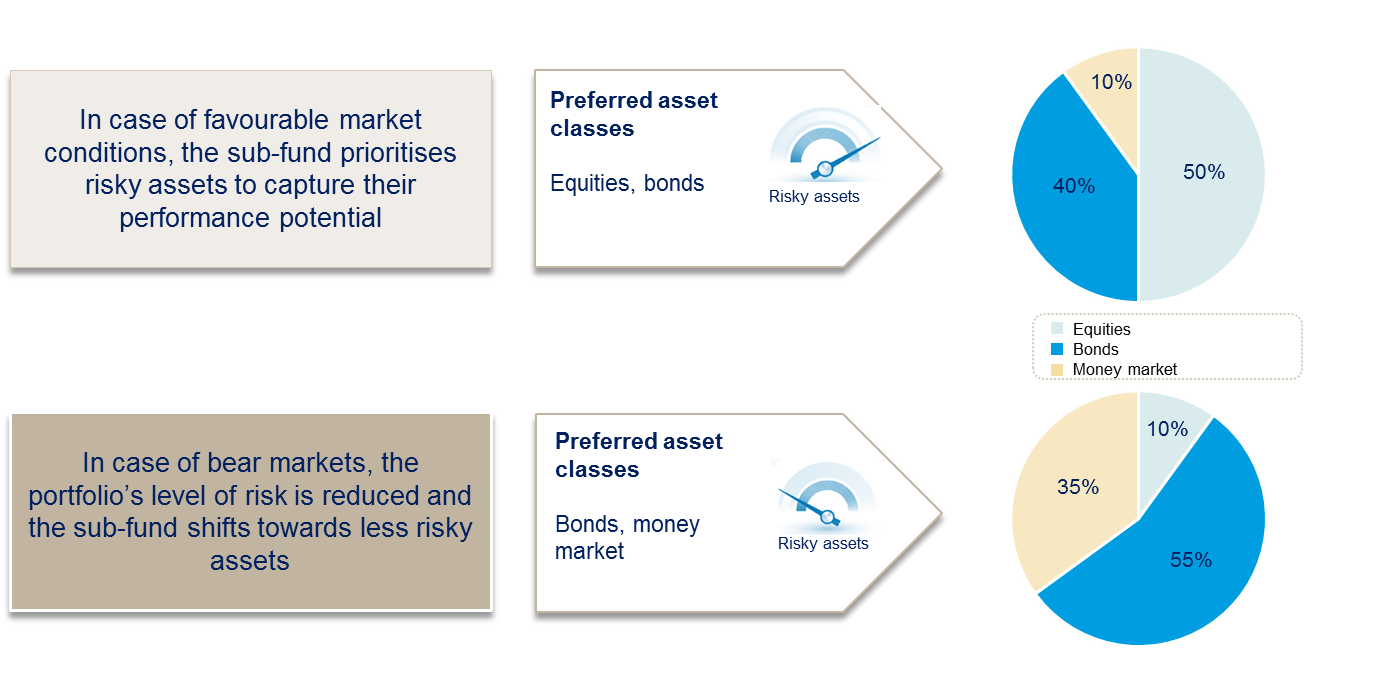

When market conditions are favourable, Amundi emphasises risky assets, such as equities and corporate bonds, to try to capture their performance potential. In bear markets, the managers reduce the portfolio’s level of risk and the fund shifts towards less risky assets (1). In the event of a sharp market downturn, the sub-fund may invest 100% of its assets in money market instruments. In such a case, it would not take advantage of the performance potential of dynamic assets.

Designed for cautious investors

One consequence of this cautious approach is the fund’s limited ability to participate fully when the market is rising. Amundi has not designed the fund to offer high returns but to encourage people into the world of investing through a product that reduces the risks by offering a partial capital protection. Although Amundi recommends a minimum investment period of at least three years, daily liquidity means investors can get their money back whenever they need it.

As well as targeting first-time investors, Amundi Funds Protect 90 is a suitable investment solution for more experienced investors who have been disappointed with the performance of multi-asset strategies and are using the fund as a transitional investment as they wait for market conditions to improve.

With a successful track record stretching back to 2008 on similar strategies for its European and Asian partner networks, the fund is backed by Amundi’s expertise in multi-asset investing and structured solutions. As conversations between financial advisers and their private clients increasingly turn to the low interest rate environment, Amundi Funds Protect 90 offers a fresh approach to meet this ongoing challenge.

When market conditions are favourable, Amundi emphasises risky assets, such as equities and corporate bonds, to try to capture their performance potential.

Isabelle de Malherbe

Head of product specialists Structured solutions

A dynamic investment strategy

Amundi Funds Protect 90 adjusts the composition of investments in line with conditions in underlying financial markets (1).

Click here to find out more about Amundi Funds Protect 90

(1) For further details on the investment policy, please refer to the Amundi Funds Prospectus

Document for the exclusive use of professional clients, investment service providers and other financial industry professionals.

This material is solely for the attention of “Professional” investors as defined in Directive 2004/39/EC dated 21 April 2004 on markets in financial instruments or as the case may be in each local regulations and, as far as the offering in Switzerland is concerned, for the attention of “Regulated Qualified Investors” as defined in Swiss applicable laws and regulations.

Moreover, this material is for the attention of institutional, professional, qualified or sophisticated investors, under the applicable law and regulations.

This material is not deemed to be communicated to, or used by, any person, qualified investor or not, from any country or jurisdiction which laws or regulations would prohibit such communication or use.

This material is not to be distributed to the general public, private customers or retail investors in any jurisdiction whatsoever nor to “US Persons”.

AMUNDI FUNDS PROTECT 90 is a compartment of the SICAV AMUNDI FUNDS constituted and compliant with part I of the Luxembourg law of 17 December 2010. This product has been authorised by the Commission de Surveillance du Secteur Financier of Luxembourg on 27 June 2016. For all other jurisdictions, investors should seek the advice of a professional advisor in order to determine the suitability of the investment, because restrictions might apply.

Subscriptions in AMUNDI FUNDS PROTECT 90 will only be accepted on the basis of its latest key investor information document and the full prospectus, the latest annual and semi-annual reports and the articles of incorporation of AMUNDI FUNDS that may be obtained, free of charge and on demand, at the registered office of the managing company or of Amundi Asset Management.

The value of, and any income from, an investment in AMUNDI FUNDS PROTECT 90 can decrease as well as increase. Past performance is not a guarantee or a reliable indicator for current or future performance and returns. The performance data do not take account of the commissions and costs incurred on the issue and redemption of units.

This material is communicated solely for information purposes and neither constitutes an offer to buy, an investment advice nor a solicitation to sell a product. This material is neither a contract nor a commitment of any sort.

Any projections, valuations and statistical analyses provided herein are provided to assist the recipient in the evaluation of the matters described herein. Such projections, valuations and analyses may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results; accordingly such projections, valuations and statistical analyses should not be viewed as facts and should not be relied upon as an accurate prediction of future events. There is no guarantee that any targeted performance will be achieved.

The provided information is not guaranteed to be accurate, exhaustive or relevant: although it has been prepared based on sources that Amundi Asset Management considers to be reliable it may be changed without notice. Information remains inevitably incomplete, based on data established at a specific time and may change.

All potential investors should determine prior to any investment decision the suitability of any investment as regards the enforceable regulations as well as the tax consequences of such an investment and should inspect regulatory documents in force for each product.

All potential investors should seek the advice of their legal and/or tax counsel or their financial advisor prior to any investment decision in order to determine the suitability of any investment before making any commitment or investment, in order to determine whether the investment is suitable for them, and should not only consider this material alone to make investment decisions.

Potential investors must consider the risks associated with an investment in a product, notably by referring them to the section “Risks” of the full prospectus of AMUNDI FUNDS in order to determine if such investment is suitable and make sure that they understand the full contents of this document.

Amundi Asset Management accepts no liability whatsoever, whether direct or indirect, that may arise from the use of information contained on this page. Amundi Asset Management can in no way be held responsible for any decision or investment made on the basis of this information.

The information contained in this material shall not be copied, reproduced, modified, translated or distributed without the prior written approval of Amundi Asset Management, to any third person or entity in any country or jurisdiction which would subject Amundi Asset Management or any of its products, to any registration requirements within these jurisdictions or where it might be considered as unlawful.

This material has not been reviewed by any financial regulator.

The information contained in this material is provided at your request, on a confidential basis only and for the use of the recipient. It is provided for the sole purpose of identifying the nature of the product mentioned in it.

The information contained in this material is deemed accurate as at November 2016.

Amundi Asset Management SA, “société anonyme” with a share capital of 596 262 615 € - Portfolio manager regulated by the Autorité des Marchés Financiers (AMF or French Financial Markets Authority) under number GP04000036 – Registered office: 90 boulevard Pasteur – 75015 Paris – France – 437 574 452 RCS Paris - www.amundi.com .”

Other news

Q1 2024 Results

A first quarter of 2024 marked by all-time high assets under management and two operations of external growth

Optimal decumulation strategies for retirement solutions

A new decumulation strategy, the “Success Rate Optimiser”, sets out income needs in advance and uses a dynamic asset allocation approach.

Global growth forecast revised higher, again

With 2024 global GDP growth forecast similar to the numbers of 2023, the IMF is no longer expecting a slowdown.