- Home

- Strategies

- Multi-Asset Investing

- OCIO Solutions

Outsourced CIO Solutions

Amundi brings its “real world” investment know-how, advisory expertise, robust research resources and advanced tools to help institutional investors addressing their financial and operational complexity.

Amundi brings its “real world” investment know-how, advisory expertise, robust research resources and advanced tools to help institutional investors addressing their financial and operational complexity.

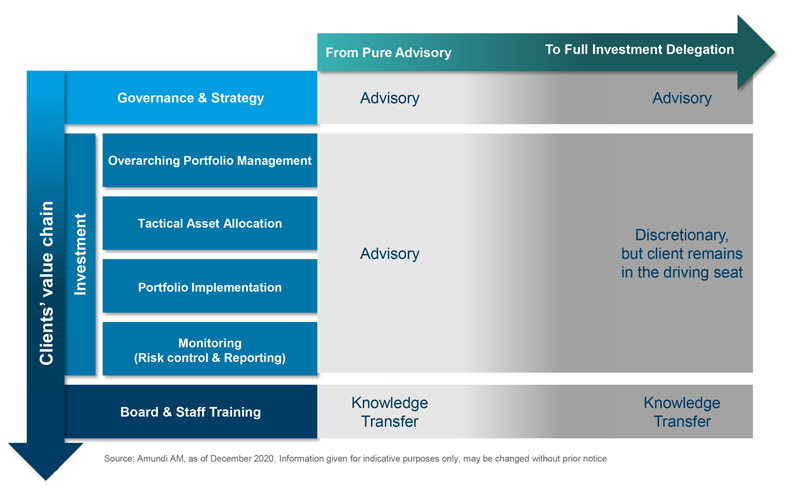

OCIO Solutions at Amundi: An ‘A la Carte’ Offer

Amundi’s OCIO offering is modular and complete. We want to be, as an OCIO, along the whole value chain of the client.

Our objective is to perform all the duties of the client’s investment committee/CIO. We can support clients when they design their governance and strategy, when they implement this strategy and all the way until monitoring, and we can help them when they have a duty of board and staff training.

We provide such a complete OCIO offering, as we rely on all the strengths of Amundi. To answer a complex and sophisticated demand from a client, the OCIO is the conductor giving access to Amundi or external experts (Investment Platforms, Manager Selection, Responsible Investing, Alternative & Real Assets, Research, etc.).

Our OCIO’s main objective is to ease our clients’ lives by transforming their challenges into opportunities.

1.Governance & Strategy

2.Overarching Portfolio Management

|

3.Tactical Asset Allocation within an agreed risk budget4.Portfolio Implementation

5.Monitoring (Risk control & Reporting)

6.Board & Staff Training |

An offer adapted to Institutional Investors' needs and challenges

We have extensive experience in providing OCIO solutions ranging from pure advisory to full investment delegation for various client types, including Pension Funds, Insurance companies, Public entities.

We have been offering OCIO solutions for Crédit Agricole Group companies for more than 30 years and for external clients since 2009.

Our close relationships with these investors provide us an in-depth understanding of the issues they face and the solutions they have adopted.

For each client segment, we have built range of OCIO solutions adapted to their specific needs and challenges.

Amundi’s OCIO Offering from pure advisory to full investment delegation

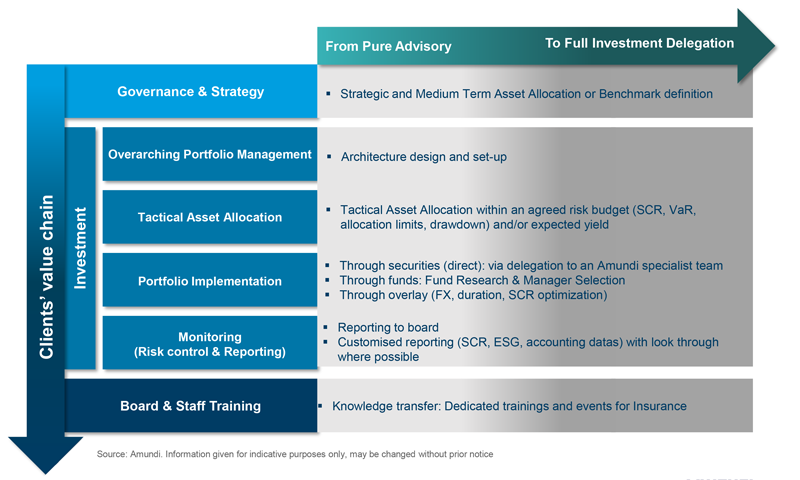

Amundi OCIO Solutions for Insurance Companies

Insurance companies are facing a series of challenges

Amundi’s OCIO offering along insurance companies’ complete value chain

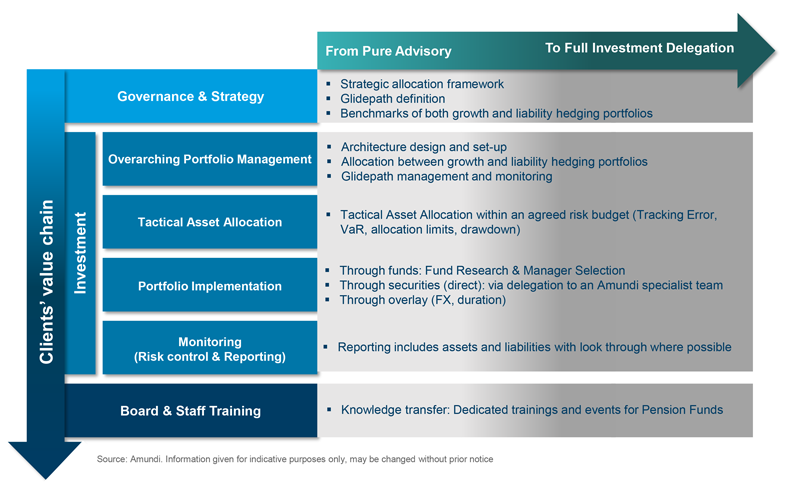

Amundi OCIO Solutions for Pension Funds

Pension Funds are facing a series of challenges

Amundi’s OCIO offering along pension funds’ complete value chain

Amundi OCIO Solutions for Public entities (Sovereigns, Supra & Central Banks)

Public entities are facing a series of challenges

Amundi’s OCIO offering along public entities’ complete value chain

Learn more

Multi-Asset Investing

Amundi offers strong-convicted diversified solutions across the main asset classes.

Amundi, A global leading Multi-Asset platform

Reasons to partner with Amundi on Multi-Asset